In the last post, we went over the difference between simply retiring at the end of a long career (and hoping to have enough money to do so) and deliberately planning for early financial independence. It is possible—actually it is very doable—to change the trajectory of things and gain financial independence years before we were currently slated for the golden age ‘retirement.’

So, how can we reach financial independence years earlier?

Saving for financial independence is a simple formula

- Spend less money & Save more money = a larger investment.

- Interest earned from your investment = lifestyle expenses.

What you do is save money and invest that saved money until you hit the crossover point. At that point, the interest earned on your principle investments equals (or is greater than) your lifestyle expenses.

If you’re imagining that you need an enormous income or the sale of a large business to become financially independent, you don’t. Sure, those things help, but that’s not really the answer we are looking for here. We can be normal people, with average incomes, and we can become financially independent.

Here are two possible saving scenarios:

- We can try to earn more money. This is not inherently bad. This does mean we might have to work more… gain a few more side hustles and have less time to spend doing things we love. In this scenario, we are trading our life energy, and our finite time, for the pursuit of money. And, who is to say that we will actually even save that extra money? Maybe we will just buy a bigger house. Another car. Or whatever thing it may be because we have the money there to do so.

- We can spend less. This is the winner. Why? Because it has a doubling impact. Simply spending less provides more money to save at the end of the month, which gives us more to invest. It indefinitely reduces how much money you need to make to cover your expenses – meaning you have that money to save and can become financially independent sooner. (The additional benefit here is reduced stress: if your expenses are lower, you can afford some breathing room in your work schedule.

Check this out:

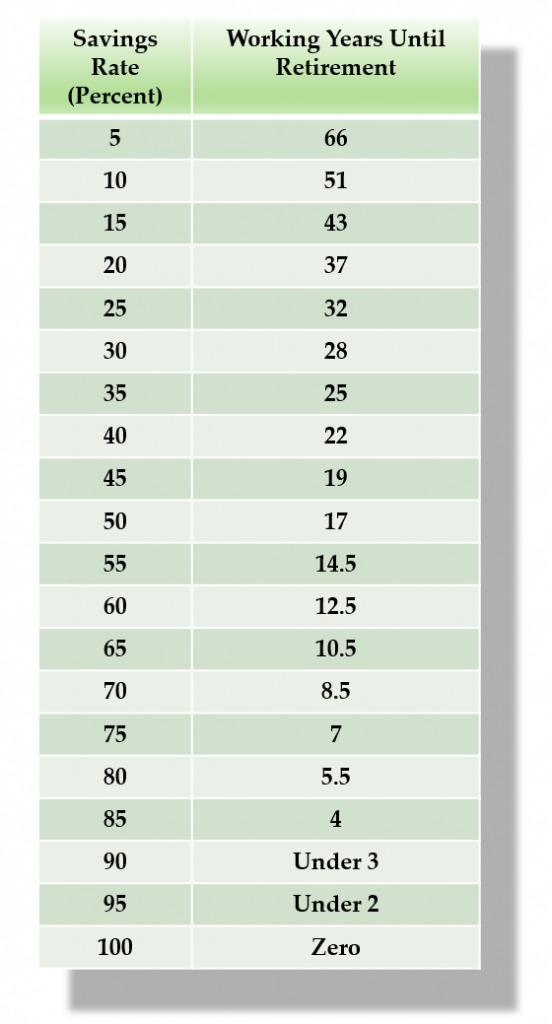

Mr. Money Moustache created a useful Saving Rate Versus Years Needed To Work chart. We can see that if you are saving 5% of your income, it will take you approximately 66 years to build up an investment that will replace your income.

And to think, the average Canadian household is currently saving around 3.4% (according to census data): this means retirement may actually be out of reach.

But what if we gave up consumerism? What if we cut out cable, spent less on groceries, downsized, bought vehicles that are 5 years old instead of brand new…

Here’s a personal example: my wife and I don’t value vehicles for anything more than getting us safely from Point A to Point B. As a result, this has allowed us to save thousands of dollars a year (i.e. close to $10,000 a year when compared to Canadian averages).

The Canadian Automobile Association (CAA) explains that, on average, when we include vehicle depreciation, Canadians are spending around $8,600 to $13,000 a year on a vehicle. For my wife and I, we choose to own older but reliable vehicles; in the summer, you can often see us peddling around on bikes with our toddler. Since our vehicles are older, we have no monthly payments and the depreciation cost is minimal, allowing us to save each month. (Stay tuned for a post coming up on the “How much does that vehicle actually cost?”)

Now take Jack, I made him up, but his story is representative of a lot of people’s. Jack is 28 years old, earning $45,000 per year. He starts saving 5% of his income (a little higher than the Canadian average of 3.4%).

As you can see by the chart above, it would take him 66 years to build up an investment that can replace his income. Now, if Jack cut his expenses by 20% and added this 20% to his current savings he would now have a total savings rate 25% (which is totally doable when we consider vehicles and housing expenses). He would now be able to become financially independent in 32 years instead of 66 years!

And if Jack really focused on saving, perhaps he could increase his savings rate to 40% and become financially independent in just 22 years! Which means our 28-year-old could potentially be financially independent at 50 years old all while having an annual salary of $45,000. This is doable.

Here’s my question to you: is it worth driving an older vehicle and maybe downsizing your house to potentially become financially independent decades earlier? Really and truly, we are talking decades!

Take your age and your savings rate (if you don’t know how to calculate your savings rate stay tuned for a blog coming your way!), and look at the chart above. Based on your savings rate, how many years until you can become financially independent? Maybe 2019 is a great year to start increasing that savings.

Sure, owning a brand-new car might feel good for a while; however, I wouldn’t know because I have never owned a new vehicle… And, truthfully, I really don’t feel like I am missing out. As mentioned, vehicles are not my thing.

Instead, I choose to redirect those thousands of dollars a year in savings towards two of my core values in life:

1. Doing Energy Creating Things (i.e. travelling)

2. Controlling My Time (i.e. becoming financially independent well before society’s current script).

If you haven’t already, take time to think through your core values. Really articulating those for yourself will make saving so much easier to do.

The important point is this: we are not talking about sacrificing our happiness now by saving all the money we earn. I often get that comment when I have these types of conversations.

Rather, we are talking about aligning our expenses with our values. I value travelling and controlling my time. As a result, I have aligned my expenses accordingly.

There you have it: it is 100% possible to become financially independent in half the amount of time. All we need to do is double our savings rate and voila! – you could be getting 34 years of your life (or more).

Take another look at the chart and see where you stand. Could you make any changes today at the start of 2019? What would you cut out first?

Shaun

No Comments